If you enjoy these comics, please help me make more by supporting my Patreon! A $1 or $2 pledge really matters.

“I’m forcing you to innovate and learn to do more with less blood!” is definitely my favorite line in this strip.

This cartoon was drawn for Dollars and Sense Magazine back in April. I put off posting it because it’s been hard to concentrate on anything but viruses and six feet of social distancing and hospitals and ventilators and flattening curves lately. I’m sure it’s been similar for you.

But life must go on – even if it’s going on almost entirely in the confines of my own house. I’m very lucky, both in that I like my house, but also in that it’s a large house with nine housemates (including myself but excluding the cats). I definitely think the crisis is harder on people who live alone. (Of course, the downside is that I have a slightly higher chance of catching coronovirus compared to if I lived alone).

Anyway, I hope you’re well. I hope you’re healthy, and able to stay that way. And I hope you’re as comfortable as you can be while we move through this crisis.

“Private equity typically refers to investment funds, generally organized as limited partnerships, that buy and restructure companies that are not publicly traded.” But in practice, this means that businesses like Toys R Us can wind up being owned and controlled by people who don’t know anything about the business and aren’t on the hook if the company goes down the toilet.

Markets don’t function if the owners of corporations make a big profit no matter what happens. But as this Vox story notes, private equity means that the new owners make a killing even if they destroy their newly acquired company.

The controversy surrounding private equity is that whatever happens to the company acquired, private equity makes money anyway. Firms generally have a 2-20 fee structure, which means they get a 2 percent management fee from their investors and then a 20 percent performance fee on the money they make from their deals. Basically, if an investment goes well, they get 20 percent of that. But regardless of what happens, they get 2 percent of the money they’re managing altogether, which is a lot. According to data from consultancy firm McKinsey, the global private equity industry’s asset value has grown to nearly $6 trillion.

Moreover, private equity firms can take out additional loans through their leveraged companies to pay dividends to themselves and their investors, and the companies are on the hook for those loans too.

Often, the easiest and most direct route to short-term profit is to load an acquired company with debt. Sure, too much debt can kill a company, but the investors get rich(er).

This is a problem that Congress could certainly address. Again from Vox:

In July, Sen. Elizabeth Warren (D-MA) rolled out a plan and accompanying legislation — the Stop Wall Street Looting Act of 2019 — taking direct aim at the sector. Her proposal would overhaul how private equity collects fees, who’s responsible for an acquired company’s debt, and how stakeholders are paid in the event a company does go bankrupt. It would also close the carried interest loophole that keeps private equity’s taxes so low. While Warren’s bill wouldn’t end private equity, it would change incentives and force firms to have more skin in the game.

Whether or not Congress will actually pass such a law, I don’t know.

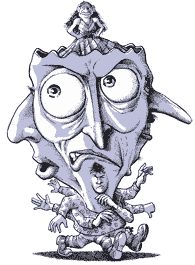

My first layout of this cartoon was four panels of middle-ground figures, all drawn the same size, on a generic city sidewalk. Then I realized that this cartoon gave me an excuse to draw a graveyard, and that was a lot more interesting to me. Panel 2, especially, was a chance to draw a panel that’s pretty different from my typical images.

I don’t know if this is the first time I’ve made the white, middle-aged, businessman-looking character the sympathetic character in my cartoon. But it would’t surprise me at all if it were.

TRANSCRIPT OF COMIC:

This comic strip has four panels. All four panels show the same two characters. The first is a balding businessman-looking type, middle-aged, wearing a collared shirt and necktie, and wearing glasses. The second character is a stereotypical male vampire, with pointy ears, pale skin, fangs, and a big black cloak.

All four panels take place at night, in a hilly graveyard.

PANEL 1

This panel shows the businessman jumping back in fear as the vampire leans towards him, leering.

BUSINESSMAN: Gasp! A vampire!

VAMPIRE: I’m not a vampire. I’m a private equity firm! I’m here to help you because you’re fragile and weak!

PANEL 2

A shot shows weeds and a bare tree and some graves, mostly in silhouette, in the foreground. Far in the background, we can see the businessman being chased by the vampire. There’s a full moon in the sky.

BUSINESSMAN: But I’m actually very healthy!

VAMPIRE: You look healthy. But you need to be owned and monitored by someone who knows literally nothing about your business.

PANEL 3

In front of a stone wall with a rickety iron-bar fence, the vampire has caught the businessman, and is leaning the businessman backward while he bends forwards and sucks the blood out of the businessman’s neck. The businessman looks very distressed, understandably; the vampire looks like he’s concentrating on his meal.

BUSINESSMAN: Now you’re just sucking away all my blood for yourself.

VAMPIRE: I’m forcing you to innovate and learn to do more with less blood!

PANEL 4

The businessman lies dead on the ground, his glasses having fallen off his face, eyes in the little cartoon “x”s of death. Standing above him, the vampire cheerfully speaks, holding out a hand in an “explaining” gesture.

VAMPIRE: So it seems that without blood, you weren’t nimble enough to adapt to a changing market. I’m sure you would have died sooner if I hadn’t stepped in!

This immediately became an all-time favorite.

Everything in this comic is true, but it only speaks to those who already have an understanding of the subject.

Ditto to what J. Squid said!!!!!

And you’ve had a lot of terrific ones.

(Sorry I can’t feed your kitty – I’m on a fixed income. VERY fixed: SSDI).

No worries on my kitty’s part! I realize that if you spoke with her, she told you that she’s never, ever been fed, but she’s lying. :-p

Thanks to c u n d and to J and to Petar! I’m glad you like my strips.

Petar, this cartoon was done for Dollars and Sense magazine – I’m assuming their readers are at least a little familiar with this subject.

Petar, this cartoon was done for Dollars and Sense magazine – I’m assuming their readers are at least a little familiar with this subject.

Well, then there is no wonder I agree with the cartoon. I have not seen it in the magazine yet.

I guess now would be the time to say I really liked “History of Corporate Whining” (years late, I know). I do not think I’ve seen a thread about it here. I saw a link to it somewhere else, and that’s how I discovered “Dollars and Sense”.

I don’t really understand this comic:

There is criticism about “corporate raiders” of publicly held companies because the stock price can temporarily take a huge drop because of market quirks and the “corporate raiders” buy up the company, sell the assets off (making a profit off the depressed stock price) and have all the workers fired.

But a private company looking to expand can either take on debt or work out arrangements for – equity – financing in return for future profits or (maybe) some kind of say in the company if that is negotiated. It seems that a start-up owner would weigh all of this and either make a good or bad business decision, but a private equity company cannot force anything on a non-public company.

People here seem to be clued in on something I am not. I would appreciate any explanation!

There are people better suited to tell you about it in general. But here is something I have seen happen twice, personally.

Extremely profitable companies are owned by multiple people. Once by siblings, children of the founder, and once by people who went in business together. Some of the people want out. The remaining people use a private equity company to raise the money to buy the companies out. Outsiders are put on the board of directors, the company is directed toward crazy, publicized expansion, a lot of money is spend on advertisement, inflating the stock price, whatever. The directors from the PEC are paid insane salaries. The company is forced to use, as suppliers, companies that the PEC is invested in, and the stocks are played with.

The original companies go under. From profitable to defunct in literally two years. The equipment is sold for pennies, to companies associated with the PEC. The directors leave, flush with the millions they paid each other in salaries. The employees… who cares.

The first time, I lost a job I had had for 29 years. The second time, I made out quite well, as I was the person who was being bought out. But I still hated seeing the company go under.

I’m especially bitter, because in the first case, we (four of the department heads, a bunch of warehouse managers, and five of the engineers) had collected enough cash to buy out the sister who was leaving. The siblings who were staying decided to go with the private equity, because of ‘the services they were offering’… which turned to be really bad advice about the future of the company.

@Petar: Doesn’t that validate what Srin is saying though? The decision to go with Private Equity was terrible – but it was a voluntary terrible choice that the company’s owners made, when other options were presented to them.

The cartoon shows the company being non-consensually assaulted by the private equity company. The company is presented as having no agency. I think Srin’s point is that this isn’t really accurate.

Görkem:

Yes, you understood the point I was trying to make.

By the way, the company “Toys R Us” was used as an example in the article above. As I understand it, Toys R Us WAS listed on the New York Stock Exchange, and that’s how a private equity firm was able to get its grubby little hands on it. The company was then taken private in an LBO.

So if you want to go public, or you want to let a private equity company just kind of take over management of your company for some money now, it’s a business decision that you have to be careful about.

Now there are some situations where a business owner can be easily flummoxed. One I have seen is when a man builds up a business over years, and his wife does not work outside of the home and is not involved in his business or any business. Then he keels over and she takes over management of the company. But people like that can be, and are, hit on many different sides with exploitive people and bad management is going to be bad management.

1) It isn’t always a voluntary choice. Many (most?) times, it is the only option available.

2) The terrible choice isn’t presented as a terrible choice. You’ll still be the managing partner! You have all the control! We can help you cut costs in transportation/supplies/services! It’s like blaming people who are victims of predatory lending. They simply didn’t have the expertise to know.

3) I have seen exactly what Petar saw multiple times, too. Fortunately, I wasn’t employed at most of those places. The ones I was employed at, I saw what it meant and got out before destruction came.

@J Squid: Re: 2), nobody is saying it isn’t horrible or a cause for concern, it just contradicts the narrative of the cartoon, where the person is assaulted by the private equity firm out of the blue while minding his own business.

Well, no, Gracchus. I am assuming that the pleasant fellow in the graveyard is a metaphor for a healthy private business. The healthy private business, itself, did not invite the Vulture Capitalists in. It was vulnerable to the invasion due to some involuntary action of the business body. Like some part of its ownership. Much like nobody decided to get COVID-19, right?

Although, if I have my guess, there will be no way for the two of us to come to a common understanding, so I’ll show myself out and let you have the floor.

I really like this comic. I especially like that the attack comes from a vampire, not some other undead monster like a werewolf or zombie. Vampires seduce their unwary victims, rather than just chasing them down and pouncing. Their bites are hidden behind kisses at first. That pose in the 3rd panel? It’s classic vampire. A zombie wouldn’t be caught undead doing anything that looked so much like date rape.

Yes, in the cases which I personally witnessed, the target company owners entered the relationship voluntarily. But when a company is publicly traded, the private equity firm often ‘pounces’ uninvited… and I believe that its leaders are very deliberate in their plan to destroy the target enterprise in order to bleed it dry.

As for the companies that did need the financial injection, and chose to deal with the private equity firm on their own… well, I’m sure that they had their reasons, and were charmed in one way or another.

I heard that the reason that our company owners declined to get the cash from their own employees was that if you added the potential shares of the engineers’ (which included three of the department heads) to the voting shares of one of the siblings, an engineer himself, you’d get a majority… and we would have driven the company into the ground by buying ourselves new toys.

So they choose to give the reins to the outside visionaries, who were definitely not engineers, and definitely did not go into buying new equipment… it would have been nice if they had just kept the maintenance up.

I do not claim that the above is the truth, I heard it from the kids of the sister who left. I am eager to believe it, because at least it means that the people who had been working next to us for decades only suspected us of ignorance, not of malice.

Here’s another way to look at it:

If you give up ownership, you give up ownership. Meaning that if you let majority control go to someone else – because you get a pile of cash or whatever right now in return – then that party is going to have control over what to do with the company. That’s what ownership means.

And this could be in the form of transferring ownership to public stockholders – leaving you open to someone buying up the stock and controlling the company – or in the form of letting a company get majority equity control. Sometimes giving up control is not such a bad thing. Microsoft people got really rich with stock.

I guess then the question becomes: Should we protect people from bad business decisions? Just certain people? Just naive people with no experience in business who take over an established business for whatever reason? Remember government interference can be helpful, but it always produces distortion in normal arms-length transactions.

One can point out that something is grossly immoral without advocating that it be made illegal. Cheating on a spouse, for example is something that most would agree is immoral, but would also agree should not be illegal.

I was going to say that buying a compny simply to destroy it is wrong, but if someone could buy an immoral business, like a tobacco manufacturer. maybe not so much.

That being said, we have all sorts of laws and regulations prohibiting businesses from making decisions that are bad for society.

I don’t think we should outlaw venture capitol, but I do think we should change the rules so that the incentive to buy a company, make money by saddling it with crushing debt, then walk away with huge profits when it folds is no longer strong.

We don’t have to ban venture capital to change the rules.

From a Vox article (same quote is also in my post above):

Kate:

That would be an exception!

I suppose one could buy RJ Reynolds and try and get it out of the tobacco business…. although I’m not sure what new business it’s well set up to transfer into.

Meaning that if you let majority control go to someone else – because you get a pile of cash or whatever right now in return – then that party is going to have control over what to do with the company. That’s what ownership means.

Do you see the difference between buying a company lock, stock and barrel, as opposed to buying 51% of the company (or even less, just enough to secure control, often by taking advantage of the lack of business sense of the other shareholders)

Because the problem is that with the current legislation, it is perfectly legal to buy 3 millions worth of shares in a 10 million company, get a 3 million shareholder to give you voting rights, take a 10 million loan in the name of the company, buy one buck worth of services from Bahama company of yours for 15 millions, pay yourself 5 million dollars worth of salary, and walk away from an empty shell.

There are Private Equity Firms which have done something almost as simple as the above multiple times, with barely a name change in between – while keeping the same address, same offices, and same employees. And there is nothing illegal about it.

(Yes, it is not AS simple. You have to throw a few wrinkles in there. Like for example the highly publicized case of a publicly funded company that went bankrupt while leasing a helicopter for a million per year from a different company privately owned by the head of the board. A helicopter which never flew. But it was there for absolutely essential emergency contingencies… just don’t ask what kind, that’s privileged information)

I was going to say that buying a compny simply to destroy it is wrong, but if someone could buy an immoral business, like a tobacco manufacturer. maybe not so much.

Buy?

Sure.

Obtain control for a fraction of the total price, and then gut the business, leaving it in debt?

Not so much, no matter how horrible the company is.

Because when you have laws allowing underhanded actions in the name of the common good, they always, always, ALWAYS get used by unscrupulous people to enrich themselves by destroying what has been produced by others.

Petar, I was talking about morality, not legality. I agree thet the sorts of takeovers you describe ought to be illegal. But, whether or not they are immoral depends on whether the continued existence of the company is moral. Similarly civil disobedience in the pursuit of justice (eg. the civil rights movement) is illegal, but moral. That does not mean all civil disobedience is moral (eg. protesters storming the Michigan statehouse in recent protests against Coronavirus restrictions). The law ought to treat such cases equally (although note who got arrested and who did not in these cases). They are not morally equivalent.

Morals are decided by sets of individuals, starting from you (or me) and going all the way to whole societies. In a perfectly rational, no-latency world, laws i.e. justice would be a perfect reflection of the morals of society. Even in that theoretical world, the laws will not be reflection of your morals or mine. At least not at the same time.

Why am I saying this? Because I am cautious about laws written by people with morals different from mine. As those pretty much include all laws, I like my laws limited.

There are people who think that the Michigan protesters are a lot more moral than the people who participated in the civil rights movement. My state is threatened with law suits by such people, for “discriminating against churches”.

Which is why Amoral Power beats Pacifist Morals 10 times out of 10. And for those luminaries who trot out Gandhi front and center, they should ask themselves how he would have fared with the Japanese instead of the British.

No! There are a huge number of immoral things that I think shouldn’t be illegal.

Me too. But, at things go today, I still think laws still tend to be TOO limited when applied to those with power, and not limited enough when applied to those without power.

They are wrong. But, when we look at who the law prosecuted and who the law let go, the results were opposite. [Edited to add: the law prosecuted African American civil rights activists and let the mostly white Michigan protesters go.}

I worked for a division of a company that used to be a separate company until another company decided that our business would fit into their business and bought it (I say “it” not “us” because that purchase happened about a year before I started working for them).

After I had been working there for quite some time the CxO suite decided that we no longer fit their core business. After shopping us around for a while and nearly getting to the point of simply closing the division and firing us all they found some equity partners that would buy us. So, first off I’m glad that they did because otherwise I would have been on the street hunting for a job about 5 years ago in an industry that thinks a 30-year old is old. And let’s just say I’m not 30 ….

In the last 5 years there have been acquisitions of 1 other company and a division of another company. There have been layoffs (mostly American) and hirings (mostly Indian). The company as a whole is now bigger and likely healthier than we once were; I cannot speak for the condition of the other two groups brought in now vs. when we bought them. I must say that I’m surprised that I am still working here, as I’m an American male over the age of 40 and they have been letting people like me go and hiring Indians. I imagine the rationale there is two-fold. They work cheaper, and it makes a 24-hour support cycle easier. Also, we don’t get raises anymore, we get yearly bonuses, which means your base pay never increases. Benefits are still very good, and there have been no changes in the vacation policy.

It’s a mixed bag. I have seen some very good engineers let go and a lot of institutional knowledge go with them. That last is rather important when you have to fix a problem on a network that was built 3 years ago and see something where you have to ask “Why is this configured like this and what will break if I change it?” at 0400 Sunday morning after you’ve been working on it since 2300 Saturday night. And they have been/are being replaced with Indian engineers that despite the stereotype are NOT as good as the ones they’re replacing. And, interestingly enough, they are often good at passing the standardized tests that get you your certifications but not so great at problem-solving techniques (especially at 0400 on Sunday morning). It’s just not as much fun to work there as it used to be. The community is broken.

And given the history of these equity partners, year 5 is about when they look to cut expenses to the bone and then sell us off while the numbers look best (before the effects of the cuts hit). Interestingly enough, the operations tempo has increased now that the Wuhan pandemic has sent everyone home. One reason would be that when your employees are working at home you need more networks. But even non-WFH stuff has increased. I’m working more hours now than before. But I think that it’s put a crimp in their plans; I don’t think that anyone’s looking to do an acquisition right now. The bottom line is that equity partners don’t buy businesses to operate them indefinitely. They want to get their money back out. We’ll see how it goes.

RonF:

Speaking as a moderator, this is not acceptable. Don’t do it again.

I prefer the Trump Pandemic. It’s a lot more accurate and a lot less racist. Those are two things I’m very much in favor of.

I prefer the Trump Pandemic. It’s a lot more accurate and a lot less racist. Those are two things I’m very much in favor of.

It’s very US-centric. Trump has done little to help the global spread of the virus. To give him credit, he is working on it, though.

Speaking for myself, anything but the official terms like “Covid-19 pandemic”, “novel corona-virus pandemic”, “SARS-CoV-2 pandemic”, etc. rub me the wrong way. Seeking political traction out of it seems low class.

As long as I see folks calling it the “Wuhan Pandemic”, I’m calling it the “Trump Pandemic”. When I no longer see that racist drivel I shall suspend my campaign.

What a wonderful privilege to enjoy, the leisure of the dilettante to both deem the preferred naming of a public health crisis “low class” and the chutzpah to suggest that preference occurred in a vacuum without political consideration of all stripes. Perhaps it’s the non-neutral nuance in it that is eluding YOU.

I’m not trying to be a smart alec here, I’m really curious and would like to see if someone can explain it:

The “Wuhan” pandemic obviously gets a big reaction.

The “Spanish” flu less so, although I have seen some people calling it different things, like the Flu of 1918 or the Great Flu etc.

“Ebola”, “Zika”, “MERS” and (actually many) others are not touched at all. I also saw a site that made it a point not to attach China to the corona virus, but in a different area show the statistics of the outbreak of the “Hong Kong” flu (H3N2) in the 1960s.

Like I said, this is something I’m honestly interested in, not something that is the basis for some Gotcha question. It’s something I don’t understand. Charles, would you have as sharp a reaction if someone made reference to the “Ebola” virus?

The “Spanish Flu” is a really interesting case, because in effect what it’s named after is that Spain had less censorship of the story than other countries. So since all the info about it was initially coming from Spain’s newspapers, it got called the “Spanish Flu” – even though it probably didn’t originate there. (The U.S., France, and China are the leading contenders for the origin of the Spanish Flu).

I can’t speak for Charles, but I think it makes sense to pick one’s battles. Ebola (the disease) has been called Ebola for nearly half a century, and the language on that is, if not irrevocably set, certainly settled in place. (It wouldn’t surprise me if most Americans who use the word “Ebola” don’t even realize that it’s also the name of a river). Covid-19 has been called “Wuhan” for just a few months, and then only by some people. That seems like much lower-hanging fruit to me.

Odd fact about Eubola (quoting Wikipedia):

It’s patently obvious that many people trying to rename “coronavirus” or “covid-19” to “Wuhan Virus” are attempting to generate that same stigma that Dr Piot, in 1976, was trying to avoid. That alone is reason enough to resist their politically-motivated name change.

OK, I guess that makes sense.

MERS was a thing as recently as 2014, though, and I’m not aware of any criticism of that name, so maybe there has been a heavy shift in thinking since then.

I said: Speaking for myself, anything but the official terms like “Covid-19 pandemic”, “novel corona-virus pandemic”, “SARS-CoV-2 pandemic”, etc. rubs me the wrong way. Seeking political traction out of it seems low class.

Mookie says: What a wonderful privilege to enjoy, the leisure of the dilettante to both deem the preferred naming of a public health crisis “low class” and the chutzpah to suggest that preference occurred in a vacuum without political consideration of all stripes. Perhaps it’s the non-neutral nuance in it that is eluding YOU.

What exactly makes me a dilletante? Using the internationally agreed terms instead of “Wuhan flu” or “Trump pandemic”, which are, according to you, a sign of expertise on the subject?

And yes, I think that using loaded terms for political gain is low-class, especially in the case of a pandemic that is currently killing hundreds of thousands. You are free to think otherwise, and use “French Disease” instead of “Syphilis”, for example. English is full of wonderful idioms like this.

The issue is that Trump and his Republican Party gave this disease names (Wuhan/Chinese Virus) when it was already known by different, perfectly easy to say and remember names (Covid-19, Corona Virus) specifically to gin up hatred against Asians.

My reasoning is much the same as Kate’s reasoning. The name was coined to gin up hatred against Asians and it plays a small part in a huge jump in anti-Asian American violence.

Here is the closest I can come to finding why MERS was named MERS. I suspect that if MERS had been a highly transmissible pandemic rather that a relatively infrequent, barely transmissible disease mostly restricted to a few countries in the Middle East, that the relevant organizations and national governments might have decided on a more neutral name. Even as it stands, I suspect the Saudi government played a role in it being named MERS rather than, say, SASARS.

For the H1N1 swine flu pandemic, my recollection was that there was an active campaign by the CDC to keep it from being referred to by its probable location of origin, specifically to avoid stigmatizing people or nations.

If the international organizations that name diseases had decided to name COVID-19 WCViD or ChiRS or something else with a place name in it, that would be its name, and I might side-eye people who insisted on using the full name, but I wouldn’t moderate it out, but given that its actual name doesn’t reference China or Wuhan or Hubei and names based on those places are specifically used as part of a campaign of racist stochastic terrorism, those names really aren’t welcome here.

I see the phrase Novel Corona Virus, which is probably more descriptive, because SARS and MERS are actually also corona viruses, but maybe a new corona virus is going to come along down the road, so “novel” will have to be replaced.

Edited to add: Why are my comments being moderated and screened? Is that customary here or am I breaking some rule? Just let me know if I am.

Tether – Email me (barry.deutsch@gmail.com) and I’ll explain about the moderation thing. But no, you aren’t breaking any rules. :-)

>MERS was a thing as recently as 2014, though, and I’m not aware of any criticism of that name, so maybe there has been a heavy shift in thinking since then.

Dafuq does MERS stand for? (Never mind, I can figure it out from these comments.) I never had to care about that disease.

Also, the first name I saw technical-minded people using on Twitter was nCov-19, which stands for ‘novel coronavirus from 2019’. The official name for the disease is basically just that – COronaVIrus Disease (20)19. You’ll notice this includes the idea of novelty, in 2020, without becoming dated. If you use a different name, either you’re a comedian/poet using something that sounds better, or you’re deliberately fouling the discourse for no discernible reason.

I had a relevant comment on a different thread that seems to be held up.

Ah, there it is. :)