If you like these cartoons, then you’d probably like my cousin Edna. And if you like my cousin Edna, you’d probably also like her special tuna noodle casserole made with tabasco sauce. And if you like my cousin Edna’s special tuna noodle casserole made with tabasco sauce, then the police are interested in talking with you about an incident on Berlington Circle Avenue last Tuesday, but they say you’re not a suspect and no need to hire a lawyer. But if you do hire a lawyer, cousin Edna knows a guy. And that guy supports these cartoons on Patreon.

There’s this thing I do in my cartoons where, anytime part of me decides to do something to save time, another part of me immediately rush to fill that void.

Like, “this cartoon doesn’t need backgrounds. Not every cartoon needs to have a background. Calvin and Hobbes often didn’t have backgrounds.” (My personal guide to if something can be good cartooning or not is usually “did Calvin and Hobbes do it?”)

…Which led to the decision to not do backgrounds. What a timesaver!

…Which led to the decision to take advantage of the faster drawing time by adding in two more panels, meaning four more figures.

At this moment, I’m actually pleased with the art. I feel like the body language and the inking doesn’t look as stiff and over-controlled as my stuff often does.

(To be clear, I don’t really think my work is unusually stiff and over-controlled, as comics go. But it is stiff and controlled compared to how I’d like it to look.)

I can’t believe that after (mumble mutter) years doing political cartooning, this is the first time I’ve done a cartoon about nimbyism!

The housing crisis hurts, and in the end, the only way of addressing it is to build more housing and make our cities – especially the cities that lots of people want to live in – denser. It’s as simple as that.

But it’s also impossibly complex to implement, because the system in the US for building more housing has so many places where changes can be vetoed. And when most of your life’s savings are tied up in a house – which is the situation many homeowners are in – any change can seem threatening.

(And of course, there’s also racism and classism in the mix. There always is.)

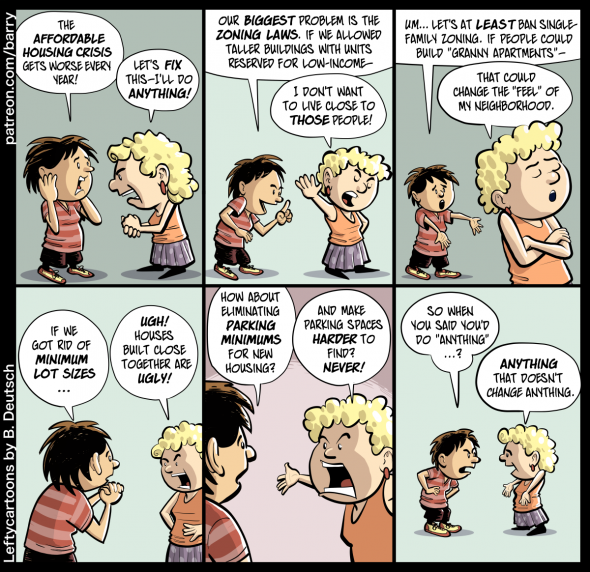

TRANSCRIPT OF CARTOON

This cartoon has six panels. All the panels show two women, one with spiky hair and one with curly hair, talking to each other. The spiky-haired woman is wearing a red and pink striped v-neck tee shirt, shorts, and sneakers. The curly-haired woman is wearing an orange tank top and a purple skirt with a pattern of large dots.

PANEL 1

Spiky is looking distressed, holding her hands to her head; Curly looks determined, pounding her palm with her fist.

SPIKY: The affordable housing crisis gets worse every year!

CURLY: Let’s fix this – I’ll do anything!

PANEL 2

Spiky is enthusiastic, lifting a pointer finger in the air as she makes a point. Curly turns away, holding up a palm in a dismissive way, looking annoyed.

SPIKY: Our biggest problem is the zoning laws. If we allowed taller buildings with units reserved for low-income–

CURLY: I don’t want to live close to those people!

PANEL 3

Spiky is taken aback, and makes her new point with a lot less confidence in her body language. Curly keeps her back turned to Spiky and crosses her arms.

SPIKY: Um… Let’s at least ban single-family zoning. If people could build “granny apartments”–

CURLY: That could change the “feel” of my neighborhood.

PANEL 4

Spiky clasps her hands in front as she makes a new suggestion, almost looking like she’s begging. Curly has turned back to face Spiky and looks angry, arms akimbo.

SPIKY: If we got rid of minimum lot sizes…

CURLY: Ugh! Houses built close together are ugly!

PANEL 5

Spiky makes another suggestion, looking unhappy, and Curly angrily rejects that suggestion.

SPIKY: How about eliminating parking minimums for new housing?

CURLY: And make parking spaces harder to find? Never!

PANEL 6

The characters are drawn smaller, as if we’re exiting this scene. Now Spiky looks annoyed, and her arms are akimbo. Curly looks cheerful and spreads her palms as if she’s making an obvious point.

SPIKY: So when you said you’d do “anything”…?

CURLY: Anything that doesn’t change anything.

It’s funny you should mention Calvin & Hobbes, because I felt the art has a bit of a C&H feel. It particularly shows in the characters’ body language in the upper right corner.

On topic, though, building and lot design rules here in Melbourne, Australia, have a whole lot of subtle requirements that make multi-dwelling buildings uneconomic. For instance, every dwelling needs an off-street car space, even ones in places with good public transport or lots of on-street parking. But if a dwelling has more than two occupiable rooms – even if one is a study – it needs two spaces. And if there are more than ten dwellings on a lot there must be an additional two spaces per ten dwellings, for visitors. The spaces must be of certain dimensions and the access road must also be of certain dimensions, and the turning spaces. The access point must not be too close to the main road or too far from it. And so forth. The best I could do laying out a corner site development was allow about 40% of the land for parking with only 30% for actual housing – setbacks and open space (which I acknowledge is important!) consumed the rest. Basement parking wasn’t an option. I could have put parking on the ground floor under the dwellings, but that would have ruled out making them wheelchair accessible without a lift (which was important to me) and a lift would have made the dwellings too expensive for low-income tenants. So in the end I passed up the development, which I suspect is what the proponents of the rules secretly wanted. There are successful multi-dwelling developments here but they tend to be huge ones that can benefit from economies of scale.

Saying my work reminds you of C&H is never off topic. :-p

It’s similar here – there’s just a huge pile of regulations, many of which – taken on their own – are good. But all of them together just create too many veto points and make building new things too hard.

Which might be okay if we didn’t have a housing crisis here (I don’t know about Australia). But we do.

By the way, lots of people now argue that setbacks are bad. I don’t feel secure enough in my understanding to have a strong opinion, but it’s interesting.

Australia DEFINITELY has a housing crisis.

Pretty much every western economy has one. Some to a greater or lesser degree, but there isn’t anywhere where housing can be considered “affordable”.

I’m not saying I disagree, because I don’t. But I’m wondering how broad the common ground goes?

How do we feel about taxing the living bejesus out of foreign nationals who buy real estate as an investment and leave the homes empty?

Metro Vancouver was infamous for their empty unit rate, with something like 15% of residential units unoccupied about 5 years ago. Vancouver instituted an “empty home tax” of 1% of the property’s assessed value and that decreased to 7%. While it might be a difference in markets, it’s not just a Covid thing, because during the same timeframe, there was an increase in the unoccupied home rate in Metro Toronto from 5.6% to 7.4% (7.4% represents more than 130,000 units.)

Could you imagine what opening up even half of those units would do for rent rates in Toronto?

Apart from the “foreign nationals” – qualifier, I think this would be a great idea. Something sort of similar is being added to the property tax code here. It is currently being overhauled because the Bundesverfassungsgericht (our version of the supreme court, basically) said that the way value was being assessed was unconstitutional.

One of the things that is going to change is that the tax rate on empty plots that are zoned for building living quarters (multi- or single family housing) will be increased, to discourage investors from buying up lots, leaving them empty and waiting for them to increase in value, instead of actually building anything.

Another change will be that the rate of units per square meter of land owned will be part of the tax-calculation. That way, apartments and/ or condos in mutli-family-units will be, on the whole, taxed less than single family homes, even if the value of the apartment equals that of the house.

(Also, there is a push for laws that would require all airBnB’s to have a government provided id on the website that they only get if they have city approval for renting the space out – which means meeting different requirements, depending on local rules, which can be set with lack of long time rentals as one of the issues to consider.)

Unfortunately, the investor’s lobby is still far to powerful, and the FDP and CDU are far to wedded to their ideas of a free market fixing all to get rid of some of the laws that make real estate such an attractive option for investment. My most hated example is the automatic 2% that get taken of profits before taxation for “decrease in value” of the property since it was baught every year for 50 years after purchase, even when real estate prices keep climbing. Investors buying real estate in bulk keeps people who might otherwise buy in the renters market, allowing rents to continue going up and completely pricing out low income families. (I am pretty sure there are far more protections for renters rights here than in the US, but there are still far too many ways for owners to increase the burden on renters to increase their profit. Austria, for example, has far better legislation, specifically to decrease the amount of real estate that is held by investors, e.g. by reducing the options for profit through better renter protections.)

Of course, all of these would probably lead American homeowners to get out the pitchforks, considering the amount of people who believe the right to their own property to be the most important on in the constitution (plus the gun to “protect” said property, of course.)

“How do we feel about taxing the living bejesus out of foreign nationals who buy real estate as an investment and leave the homes empty?”

Do you think this is fine as long as it’s done by non-foreign nationals?

It’s always convenient when the villain of the piece turns out to be the nasty foreigner, not us good loyal (Canadians/Australians/Americans/whatever)

“Metro Vancouver was infamous for their empty unit rate”

How do you know the people owning apartments and keeping them empty are foreign nationals?

Why not just tax all empty units? Why bring citizenship into it?

Even if you’re right and most people doing this -are- foreign nationals, there’s no reason to limit enforcement to them. Or do you feel non-foreign nationals keeping apartments empty are somehow doing a valuable service?

Corso:

Looking at the article you linked, I think you may have misread the numbers. The new laws seem to have led to a decrease in unoccupied units, but not as dramatically as you say here. From the article:

But the law did add 5500 units to the residential stock, which seems like a very good thing to me, and a good reason to favor laws like this one. So I’m not really disagreeing with you, just saying the numbers might not be as dramatic as you thought.

(And the new tax law applied to all property owners, not just foreign nationals.)

Totally did. Embarassing. I knew it was an issue, I thought 15% sounded about right, and I misread the lines.

I got a little pushback on “foreign nationals”. The reason I mentioned it is because my understanding is that the issue, particularly in Vancouver, is primarily caused by Chinese real estate investment, and I have the impression that a tax on everyone (which you’re right, this was) was still going to disproportionately effect those Chinese investors, but if there are domestic corporations holding empty buildings, I’m more than happy to tax them too.

Real numbers: As of 2015 one third of Vancouver’s real estate was owned by Chinese investors. Now…. Obviously some of those investors are living in or renting their units… But I don’t think you can really dig into that conversation without mentioning the reality of international real estate investment.

5500 units is massive in any market. We’re experiencing a housing crisis, and investors are exacerbating the issue, if we’re going to have tax codes 3000 pages long, we might as well tip the scales in favor of dealing with issues like this.

“The reason I mentioned it is because my understanding is that the issue, particularly in Vancouver, is primarily caused by Chinese real estate investment”

Even if this is the case, there is no conceivable need to narrow the scope of any legal redress.

Murders are primarily caused by men, but we make it illegal for women to commit murders also.

Amp –

I certainly understand how important it is that we have more commentary about NIMBYs. In fact, it’s an issue that has been near and dear to me for years. Why, I would give anything to ensure that this issue is given a very large platform. It’s essential for us to talk about this.

But, really, this blog covers so many important issues. Can’t we talk about NIMBYs on Reddit instead?

/sarc (in case there is any question)

Gorkem @ 9

We might end up disagreeing here. Buying investment property is not the same as committing murder, and I can think of a couple of good reasons you might want to have a different rulesets for foreign purchases of real estate. I can’t speak to American laws, but we already have different rulesets for foreign ownership and taxation here.

All that said, I think that the problem is big enough right now in a whole lot of metro markets that taxing all vacant property with the aim of freeing up units makes sense, but I don’t think the argument for specialized tax is unreasonable in markets you wanted to have a lighter touch on.

I’m old enough to remember the scare about the Japanese buying up all the US real estate, especially in NYC. We survived that better than we’re surviving American corporations buying up all the residential real estate in the US, so I’m not particularly frightened by Chinese or Russian ownership of US real estate except when it’s being used to launder money. But there are already laws about money laundering so…

” I can think of a couple of good reasons you might want to have a different rulesets for foreign purchases of real estate”

What are those reasons? Not wanting to have to live around too many of those foreign-types, perhaps?

Fibi – LOL!

Gorkem:

Since Corso was (if I’m following the discussion correctly) specifically talking about absentee owners of empty houses, that doesn’t seem to follow from what he said.

That said, I’m curious as well. I know, after a bit of googling around, that there are rules limiting the ability of foreign investors to buy property within a mile of US military bases, and agree with it or not, the rational for those rules is easy to see. There are other security-related rules – for instance, if a foreign company owns a rental office building here in the U.S., there are extra hoops to jump through if a federal agency wants to lease an office in that property.

I know there are some extra tax forms that foreign owners of US property need to fill out. And there are some agricultural assistance programs that aren’t available to farms owned by foreign investors, although sometimes a resident alien would qualify for that assistance. I’m not sure there’s a good reason for any of that – something like 97% of US farmland is owned by Americans, so it doesn’t seem like there’s any security issue there.

Yes, obviously the person who has lived in 8 different countries has HUGE issues living beside foreign owned vacant property. Someone might cook curry near me.

But seriously… The phenomenon of foreign investors buying huge swathes of metro real estate isn’t uniquely a North American thing, but it’s very disproportionately a North American thing. My understanding is that other markets are less lucrative for them, and there’s a whole lot of different things driving that…. but a part of what’s that is that many nations, China among them, simply won’t allow that kind of investment, with this kind of inflation in mind. China would not allow Canadians to own a third of the real estate in a major city.

Not to put too fine a point on it, but several people here seems to act like a different tax law for foreign ownership is somehow egregiously beyond the pale and in need of a defense, ignoring that different rules for foreign ownership of domestic property is the norm in basically every nation on Earth.

Be specific… What’s your arguments against that?

We’re seeing in real time how the commoditization of real estate is really putting the squeeze on low to middle income families, and home ownership is a pipe dream for young people in most metro markets. Our ability to build is finite, land is finite, and I see no good reason to allow foreign markets to squeeze our middle class so they can have a spiffy investment vehicle. We need to offer our kids something better than platitudes.

The obvious response is that you might not see a reason for our investment class to squeeze our middle class, and that’s fair, and I agree, which is why I don’t have a problem with the universal tax. But foreign ownership seems like really low hanging, effective fruit. Again… Chinese investors owned a third of Vancouver five years ago, and that was the height of the vacancy problem. The tax law disproportionately effected them, whether it was explicitly targeting them or not.

The way you’re stating this is a bit ambiguous, in a way that people could misunderstand.

It is not the case that 1/3 of real estate in Vancouver was owned by Chinese investors as of 2015. That makes it sound like one out of every three square miles in Vancouver was owned by Chinese investors in 2015, which seems implausible to me.

What was found, by what the writer described as a “back of the envelope” calculation, is that a third of the monetary value of real estate investment in Vancouver, during a one-year period ending March 2015, came from Chinese investors.

That’s a lot, and I’m not trying to claim it’s not. But I thought it would be worth being more specific about what that stat refers to.

I wish NYC would add an empty unit tax. There are whole buildings that are basically empty but all sold to oligarchs who use them about once a decade. I’d advocate expropriating the lot and giving them to the homeless except that they’re generally the small footprint mega high rises that have leaky plumbing, elevators that break down, and sway in the wind enough to cause sea sickness. So I’m going to advocate expropriating all said oligarchs’ other houses and apartments instead.

there are actually three sets of taxes in Vancouver:

1) Empty Homes Tax. this is part of the Property Taxes levied by the City of Vancouver, and applies to residential properties within city limits that are vacant for more than six months of the preceding tax year. for 2021 it is 3% of the assessed value of the property

2) Speculation and Vacancy Tax. a provincial tax for residencial properties deemed vacant in the preceding year, in specific areas of BC deemed especially vulnerable to speculation, including (but not limited to) the City of Vancouver. there are two rates for this tax — “2% for foreign owners and satellite families; and 0.5% for Canadian citizens or permanent residents of Canada who are not members of a satellite family”

3) Foreign Buyers Tax. this is an additional Property Transfer Tax of 20% on residential properties, in certain areas of the province, when they are purchased by people who are neither Canadian citizens nor permanent residents of Canada

I’ll put some links in a subsequent comment (I’m worried about them causing this one to be shunted to the spam filter)

citing my sources :))

1) https://vancouver.ca/home-property-development/empty-homes-tax-frequently-asked-questions.aspx#about

2) https://www2.gov.bc.ca/gov/content/taxes/speculation-vacancy-tax/how-tax-works/tax-rates

3) https://www2.gov.bc.ca/gov/content/taxes/property-taxes/property-transfer-tax/additional-property-transfer-tax

Limiting foreign buyers has the effect of keeping any rent/lease money inside the country rather than being siphoned off elsewhere, I suppose.

Mexico forbids foreign nationals from buying real estate within 50 Km of the seacoast or 100 Km of an international border unless they buy it through a Mexican bank trust with a maximum term of 50 years. IIRC there’s plenty of countries that treat foreign ownership of real estate differently than by citizens.

I can see depreciation on the buildings – they do have to be maintained and do wear out. The land, not so much. And if the prices keep going up so would the property taxes, which will offset that some.

Dragon Snap, thank you for all that info!

“Limiting foreign buyers has the effect of keeping any rent/lease money inside the country”

Just because I am a national of [X country], it doesn’t mean that I will keep any profit I make from my rental business inside [X].

Conversely, just because I am not a national of [X], it doesn’t mean I will send any profit I make from my rental business outside [X], either.

My point is that there are two scenarios.

Either foreign investors -are- a disproportionate part of the problem, and therefore a general solution will effect them disproportionately without having to target them.

Or alternatively, foreign investors are not a particularly significant part of the problem, and therefore a solution that specifically targets them will be suboptimally effective.

Of course punitive measures against foreign investors will have some effect, just as punitive measures against investors with blue eyes or whose name starts with “B” or who are born in April or some other arbitrary slice of the population would have some effect, since it would be more than nothing. But that isn’t a positive argument for any of those measures, either.

I am 100% aware that such measures are common internationally, but that doesn’t mean they’re a good idea. A common mistake is still a mistake.

Actually, I had thought that the reason why so many foreign investors wanted to invest in American real estate was that they wanted to a) get their money OUT of their native land so as to make it less liable to seizure from their own governments and b) put it into a more stable economy that will provide them with better rates of return.

Görkem, I think I agree with you for the vacant/empty residences part of things, it makes no sense to have different rates for people depending on if they are a landed immigrant/permanent resident or citizen; or if they are not.

For the property transfer (i.e. purchasing) tax I can see the reasoning of “if you don’t live here, we want to disincentivize you from buying property that people live in.” That is, the attempt is to maximize the ability of people to purchase a place to themselves live, and while there’s no guarantee that “foreign” purchasers won’t live in the unit (since work and education visas exist), I think there’s a much greater likelihood of foreign purchasers buying residences *as* an investment rather than a dwelling.

But for me, I would way rather 10% extra property tax on a second residence, and 100% extra property tax on third, fourth etc residences, for everyone (and corporations too). And then also a $10 000 000 cap on assets (cash and land and stocks and all of it) for people, excluding your primary residence. No one needs to amass a fortune greater than $10 000 000, plus a nice house. But I guess that’s more of an open thread discussion :)

RonF @25: At one point my partner and I were considering buying property outside the US for those very reasons. IIRC, in the end we didn’t because US laws made it too difficult and expensive to do so. (There’s some possibility that I misremember, but I seem to think that there was some law at least ostensibly intended to protect USians in some way that led to the investment being impractical. Make of that what you will given the Republicans determination to destroy the US economy.)

No, but you’ll earn it in X and X will have the option to tax you on it at the point of earning. As opposed to the resident of Y who pays their taxes to Y.

And, BTW, the resident of X is easier to get ahold of if rental laws are broken, property is allowed to fall into disrepair, etc.

Which is why I am ok with maintance/ renovation costs being counted as losses when it comes to taxation. Over here, they get both. I hate it!

And certain renovatioms allow the owner to increase rent (There are a lot of regulations on rent for spaces that people live in, as opposed to commercial use, but the lobbyist really made investors happy pushing that one through. Renters rights on the whole seem to be a lot more protected, mostly disallowing termination without cause, but there could always be improvements)

(Also, with our laws regarding real estate, technically you are always buying the land, it just happens to have a house on it (if you buy a condo in a multi-unit-building, youare buying a percentage of the land that is “common usage” as well as the right to have “singular usage” of the part that is your apartment. It is …complicated.) Of course, in reality the building on the land has a huge influence on the price, but the contract/ all government registries etc. will still record the land, not the house.

Stumbled across an interesting youtube channel that reminded me of this discussion.

Not Just Bikes

While the main focus seems to be on roads/ traffic, there is a lot of great information about the issues with northern American city planning, including how those cause land waste and housing shortages. I recommend the series on “strong cities”, very easy to grasp despite the complicated topics.

“No, but you’ll earn it in X and X will have the option to tax you on it at the point of earning. As opposed to the resident of Y who pays their taxes to Y.”

But the proposal was to tax based on citizenship, not residence.

What proposal? I don’t think there’s been a discussion of a real world proposal here, or indeed any real world laws except the Canadian laws, and those treat permanent residents the same as citizens.

I don’t know of any country that treats permanent residents as different from citizens when it comes to property taxation, except in that if a permanent resident lose their residency status (by moving out of the country) they lose out on the benefit, while citizens do not.

“I don’t know of any country that treats permanent residents as different from citizens when it comes to property taxation”

Trust me, they exist. I live in one.

Corso said “How do we feel about taxing the living bejesus out of foreign nationals who buy real estate as an investment and leave the homes empty?”

He specifically mentioned foreign nationals, e.g. people with foreign citizenship. Nothing about residence.

That’s the proposal that sparked this discussion.

Fair enough, though Corso’s further clarifications made it seem to me that he didn’t mean “foreign nationals” in the sense of “non-citizen residents” but in the sense of “people outside the country”.

Also, don’t you live in Spain? I’m far from an expert, but a google search on Spanish property taxes leads me to a lot of advice for foreigners seeking to buy Spanish real estate, all of which distinguishes residents from non-residents but not citizens from non-citizens.

I also said “as an investment and leave the homes empty.” Which, I think I’ve clarified, a lot, I feel is orders of magnitude more important than “foreign nationals”.

It’s so weird reading people in this comment section angrily agreeing with me as if they’re refuting every point I’ve made. We agree on this, generally. We disagree on whether separate tax rates for non-citizens should be permissible, obviously, but that seems like flavor more than content, particularly since I’ve said that I don’t have a problem with blanket anti-investment laws.

I just learned (through a video on possible tax crimes Trump might have committed, which …make of that what you will) that claiming automatic depreciation of commercial (to the investor, might be living quaters or commercial use to the renter) real estate is a thing in the US, too.

I get that sometimes, having a fixed rate makes it a lot easier on the tax authorities than if they had to audit every individual claim of reduction in value, but that definitely shouldn’t apply during a time when value keeps going up. Let people deduct actual costs of maintenance/ improvement (possibly streched out over several years) but automatic deduction of depreciation is just an incentive for investors – since people buying homes for themselves can not claim these, as their home is not a business expense.

(Also, why is depriciation of investment properties a deductible loss at all? Can owners of factories claim depreciation of machines? Can a reduced stock marked value of shares be deducted?)

On the plus side, one of the things I like is that landlords here have to prove an actual reason – beyond just wanting to make more of a profit – to raise rents (of course, conservative and libertarian lobbyists made sure there are far too many possible “reasons” in the laws, but at least there is something).

Laws regulating rent and in a similar way laws regulating employment seem to be a lot stricter in western Europe than in the US in general, especially when it comes to “no cause” – terminations of contracts.

CPA here (but Canadian, so grain of salt).

1. There’s a tradeoff… Homeowners don’t pay tax on gains on their primary residence when they sell, but if they take a loss on the property, they can use the loss as a deduction. Depreciating something that you don’t pay gains on would, in effect, double-dip. Homeowners with a *second* home *might* be able to depreciate the second home, but that comes out in the wash… Depreciating lowers the value of the property, when you eventually sold, it would effect your loss/gain calculation.

There are mixed opinions, but my impression is that this is actually weighted towards homeowners: If they lose, they at least get the deduction, if they gain, they don’t pay tax… At least on your primary residence. Corps would *love* that.

2. Almost certainly…. Depends on the machine, and the use, but probably.

3. Not unless the stock is sold.

If you buy a share at $100, and by the end of the year it’s worth $110, you pay zero tax. That’s called an “unrealized gain”. Same for the inverse: If you buy a share for $100, and by the end of the year it’s worth $90, you do not get a deduction. That’s called an “unrealized loss”. Once you sell the share, you compare the purchase price to the selling price and regardless of all the peaks and valleys between purchase and sale, the final difference is “realized” in the year it’s sold, regardless of whether it’s a loss or gain, and you take the gain or loss.

“We agree on this, generally.”

Thanks for explaining my own opinion to me, Corso.

Over here, buyers (private buyers who want to live in them as well as investors) pay the tax (“Grunderwerbssteuer”) when a private owner sells the house/condo (don’t ask me why, I do not know. As I said before, real estate law is weird over here). Private sellers only have to pay taxes if one of the following applies:

– they lived in the property during at least three calender years (which can actually be just a year and two days, eg. December 31. of 2019 to January 1. of 2021)

– they owned the property for at least ten years

Also, they must not have sold more than 3 properties over the course of 5 years.

So most private home owners selling their homes will not pay taxes, unless they buy a new place at the same time for which they have to pay them. Which means that any decrease in value is not off set by anything. Investors, on the other hand, can dramatically increase their ROI simply because when it comes to taxes, the gowernment pretends that they are loosing money through depreciation when the property is actually increasing in value…

But I get that this is different from country to country, and has drifted rather far of topic… which, to get back to a bit more: I don’t think it is the only factor, but fixing the housing crisis definitely requires taking a hard look at all the policies which are ostensibly intended to incentivice investment in new developements and actually just end up turning existing housing stock into investment properties.

One of the other important factors, if we do not want more and more urban sprawl, is to let go of the ideal of every family owning their own home with their own garden…and infrastructure provided by the city, despite rising costs and decreasing income generated by suburbia. Seriously, those videos i rec’ed are super interesting, or alternatively a look at the “Strong Cities” website, especially the stuff about what makes a city financially sound (tl, dr: right now, most of them are not, constant new single-family-home developements are a pyramid scheme and the city’s poorer people/ neighborhoods are subsidizing the richer people/suburbs. Also, as a bonus, quality of life, safety of all participants in trafic and sustainability can be increased with multi-use zoning and different street/ road functions)

Such low fruit… I can’t resist.

1) You’re welcome!

2) What made you think the comment was about you?

3) What, exactly, are you disagreeing with?

4) Perhaps I was just agreeing with you less angrily than when you agreed with me.

I think three is the most important. Again… you have this awful habit of shallow contrarianism where you seem to take offense when I say our positions are close…. But never really get to how your ideas different. You might actually disagree with me materially… I just don’t know how.

Hard agree. There won’t be a one-size-fits-all on this… I like this topic because it feels like one we can really make inroads on by dealing with some obvious issues.

As another example… One of the more surprising differences between American and Canadian home finance (to me) was that in America you can deduct the interest portion of your mortgage payment. We don’t do that here. The practice doesn’t seem horrible on the face of it, but it does things culturally with home ownership that isn’t great – It makes home-backed debt “cheaper” than other debt vehicles and that incentivizes people into making home payments and never owning your home.

For example: Don’t take out a car loan – Mortgage your house and buy the car for cash. Meanwhile…. If you get behind on your payments, you lose your house instead of your car…. Which will almost definitionally be worth much less than what you bought it for, even if your home is worth more.

It feels two-tiered and predatory.

“you have this awful habit of shallow contrarianism where you seem to take offense when I say our positions are close”

You’re a conservative nationalist. Our positions are not close. If you think they are, then I can’t help you.

Let me finish that for you:

you have this awful habit of shallow contrarianism where you seem to take offense when I say our positions are close…. But never really seem to get to how our points differ.

Again…. What are you disagreeing with?

Lauren, @ 36:

Yes. In fact, there are multiple fixed schedules of depreciation based on the type of machine it is, and companies take that into consideration when planning their capital and expense budgets. The concept is that this enables companies to increase their capital budgets. Capital assets have to be manufactured, installed, maintained, etc., so buying them helps the economy via employment. The depreciation is carried as an expense that in turn can be deducted from income for tax purposes.

Dianne @ 27:

You think there’s countries that have economies that are more stable than the U.S.’s and where private property is less likely to be seized by the government?

Corso @ 37:

In the U.S. you do pay tax on capital gains from the sale of your primary residence unless you are over (IIRC) 65 and purchase a less-expensive primary residence. In other words, you are allowed to downsize your primary residence w/o paying capital gains tax once in your life once you are past a certain age.

Lauren @ 39:

I live on 3/4 of an acre of land (0.3 hectares, 3,035 sq. m.) in a modest 1,500 sq. ft. house. I am a few hundred feet from the northernmost tip of a large forest preserve. I am about 1/2 hour away from downtown Chicago. I love going into Chicago. But between the crime, the congestion, the pollution and the poor schools I would never have wanted to live there. I love being so close to the woods and having it quiet and uncrowded where I live. But lots of other people don’t have the ideal you describe. They feel differently; they find the easy access to varied cultural amenities, the mass of people, etc. exciting and fulfilling and the other factors don’t bother them as much (especially those without children). Good for them! It takes all kinds to make a world.

Although I have noticed that young couples (around here at least) love to live in the city and have a great time – until they have kids, at which point there’s a distinct tendency for them to move out to the suburbs.

My point is that there are plenty of people who do have the ideal you describe and plenty who don’t. I have no issue with either. What I will have an issue with would be if one or more levels of government seek to impose urbanization on people.

Corso @ 40:

The actual effect is that without that tax deduction many people would be unable to afford to buy a home in the first place. The amount you can deduct is large at first because your first home payments (absent the tax escrow you pay) are almost all interest. As that goes down your income is generally going up, so you are more able to afford the payment without the assistance of tax deductions. It wasn’t a choice of getting a loan for my home so I could pay cash for my car. I have had several new cars and have never paid cash for any of them – I paid both loans simultaneously until my last one. Eventually you DO own your home (as I now do, at least as long as I keep paying my property taxes), so I don’t understand your last phrase at all.

I can’t comment about economic stability because I don’t understand how that is measured. But I don’t know why you are under the impression that private property in the US is more protected than in most other Western democracies.

“Again…. What are you disagreeing with?”

You’ve made it abundantly clear that you don’t attach any value to my opinions. Please do us both a favour and stop pretending otherwise.

Ron @ 43

(Numbers and accents added by me)

What you’ve described is…. unhealthy.

1) Most (if not all) housing markets outside America operate without a mortgage interest tax credit. But to be fair: America does have it, and so getting rid of it immediately would have the effect of making homes less affordable… At least in the short term. But home prices would eventually lower, absent that tax. You’re right… homes at current prices would be less affordable without that deduction than they are now. But people selling their homes would still want to sell their homes, and without the same number of buyers in the market, it would become more of a “buyers market” and there would be pressure on home sellers to reduce prices to where the market could move homes at something like the current rate.

Which means, in practice, your government is using your tax code to subsidize a housing bubble and has artificially inflated the price of a home.

That’s awful. From the perspective of a first time buyer this is crippling. The single largest roadblock to home ownership is the down payment, and the down is usually required to be a percentage of the purchase price. Your interest rate is sometimes effected by the down/price ratio. And all the fees associated with land transfers are either tiered or a percentage. People are being nickel and dimed out of the market. Even if someone is able to participate, having a tax deduction is cold comfort when the alternative was just paying less interest.

2) I’m sure you meant that to be a not-so-subtle brag, but first… Your personal financial situation is an anecdote, and second… What you described doesn’t really make financial sense… The deduction does bad things for the market, but it’s there, and not taking advantage of it is… weird. You *should* take advantage of it. And that kind of answers your confusion: Of course, at some point in your life people get out of debt, and maybe you aren’t taking any new debt on…. But if you are, it should *always* be mortgaged, if the option is available, because that rate is per se better.

And that’s a problem because access to relatively “cheap” credit incentivizes indebtedness. The average American carries almost five times the amount of household debt as the average Canadian.

I am not talking about local government forcing people to all move into the city. I do think that they need to stop incentivising urban sprawl through single use zoning, bad (hostile to pedestrians and bicicle riders) inner city road design and bad public transit.

I am not going to summarize all the videos I liked, but one of the reasons urban sprawl is bad for cities financially is that while new developements increase tax income on a short term basis, the long term maintenance of infrastructure far outweighs those short term gains. Which means more and more new developements, to have new short term gains to pay for the long term costs. Thus, a pyramid scheme. To make suburbs at least financially brake even, people who want to live in single family houses outside of big cities would need to accept certain reductions in infrastructure-wells and septic tanks, above ground electrical etc. As is, even run down inner city areas that have not been “revitalized” (gentrified) generate far more income for the cities, subsidizing suburan standards of living.

Considering all the other issues with those new developement suburbs (total car depence and its effect on the environment, destruction of natural habitats, lack of diversity etc.), there is absolutely no reason why this should continue to be a heavily tax-subsidized model of developement. Which yes, means that maybe the people who insist on the luxuries of newly developed single family housing will have to pay more for it- but if the tax revenue generated in the inner city was actually used there, to improve things like public transit, public parks, community centers, schools and childcare options etc, less people would feel like they need to flee the city.

(Why not create smaller towns close to the bigger cities instead of giant cookie cutter suburbs? Towns with their own centers with shops, maybe some enternainment options, school and daycare? Walkable and bikeable, but laid out the way that towns used to “grow naturally”, instead of a grid of houses that – thanks to single use zoning – are so far removed from everything that it is impossible to even pick up groceries without a car.)

I realize that my point of view is heavily influrnced by having grown up and currently living in a western european country, which means a much higher average population density than the US. While we have far fewer multi-million-inhabitant cities, land in general is a precious comodity. Which comes with it’s own problems, but the way land surrounding the cities is used with seeemingly no thought in northern America left me rather flabbergasted the first time I visited family in the States.

Those giant parking lots in the middle of nowhere, surrounded by giant one story halls filled with anything one might want to buy? Apart from being ugly, they pretty much scream “land is cheap”. Which even in a less densely populated area is only true when you do not make the land owners pay for the environmental impact of their construction. (also, why on earth does there need to be a twenty meter isle of nothing but cereal? And another with two thousand kinds of snacks? I am not talking about healthy eating here, I actusslly love US junk food, but why sooo many different versions of the same thing?).

I don’t have to live with it, but the sad fact is that developents similar to US suburbia have been creeping up more and more here. I wish our local governmants would look at the scholarship on all their negative effects, instead of touting them as the solution to our lack of affordable inner city housing.

@Lauren: One of the major differences between European and US (and Canadian and Australian and NZ) cities is that the former were laid out before the invention of the automobile, and for the most part have a street pattern that is based on people getting around on foot or horses. A few American cities have this – New York is the classic example of an American city with a pre-car layout. But those large carparks are not an exclusively American phenomenon – they are found in Canada, Oz and NZ as well.

Yeah, the fact that so many cities were planned instead of developing over time, and that a lot of that planning happened after the proliferation of the car is quite obvious. That being said, just like a lot of our cities were adjusted to be drivable (though with a lot of one-lane or even one-way streets), if planners wanted to change things up for new developements, they could. Walking and biking-only areas (except for public transit, emergency vehicles, people with disabilities and deliveries), with smaller shops in the city-center, which are multi-use buildings with apartments above the commercial floors below. Playgrounds and green spaces. Cafes and restaurants with outdoor dining where one is not constantly subjected to car emissions. Space for a farmers market. Bike-lanes. Gradually increase the amount of traffic by giving each direction their own lane and surround the center with multi-family dwellings, shops on the ground floor where feasible. More playgrounds and green spaces as well as local supermarkets in the different quaters. And then, if absolutely necessary, single-family housing on the outskirts. But again, centered around common use spaces. Safe the outermost areas for small industry, as well as shops you would have to drive to anyway- furniture, garden centers, building supply etc. (And a tax code that encourages multi-family housing or mixed use over single family homes)

No, newly developed cities/ towns/ settlements/ suburbs build that way would not suddenly magically acquire the charm of those that grew organically over centuries, but they would still be much more livable – and financially sound.

And again, this is not me feeling superiour. North-American, Australian and NZ- style planning is something that happened here in the past 70 years, as well. And our nicer older cities aren’t that way because of smarter intentional planning but because they developed much more slowly, instead of being the result of concious planning with the goal to establish a settlement/ expand a city as efficently and quickly as possible. Obviously, colonised nations have a completely different starting point from coloniser nations.

I just think that, when looking at the housing crisis, attempts to combat it need to take in considerations of health and sustainability – which in this case includes mental wellbeing and financial sustainability as well as ecological concerns.